| |

Numerator Debuts Tariff Risk Index

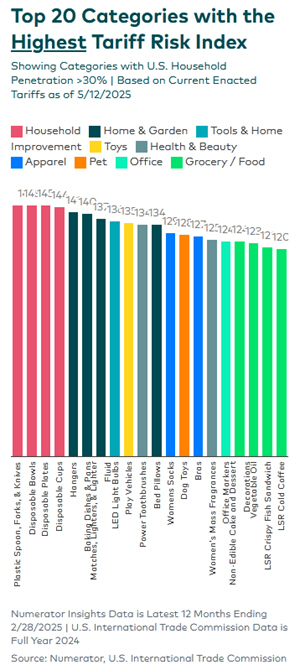

Kantar business Numerator has unveiled the Tariff Risk Index, a new analytical framework bringing government trade stats together with its own consumer purchase panel and survey data to measure the vulnerability of different categories of business to tariff-driven disruption.

Acquired by Kantar in 2021 for $1.5bn, Numerator is merging with Worldpanel, keeping its own name and its CEO Eric Belcher. The combined company will be headquartered in Chicago and will have around 5,800 employees worldwide. It has recently announced its expansion to Europe, starting with an app launch in Germany; and a near doubling of the size of its US 'Total Commerce Panel'. Acquired by Kantar in 2021 for $1.5bn, Numerator is merging with Worldpanel, keeping its own name and its CEO Eric Belcher. The combined company will be headquartered in Chicago and will have around 5,800 employees worldwide. It has recently announced its expansion to Europe, starting with an app launch in Germany; and a near doubling of the size of its US 'Total Commerce Panel'.

The new tariff index is calculated from a blend of five variables: import reliance - categories with higher import reliance face greater disruption if trade barriers tighten; tariff exposure, evaluating where imports originate and how rates vary by country based on current policies; category buyer purchase power, identifying those more dependent on price-sensitive lower income consumers; US consumer sentiment - regarding preference for buying US-made products; and price sensitivity, measuring how responsive overall consumer demand has been to price changes over time.

A Tariff Risk Index score of 100 means the category has average exposure to tariff-driven disruption, while a score of 145 means it is 45% more exposed than the average category - and so on. Despite the slashing of Chinese import tariffs from 145% to 30%, Numerator says that items heavily reliant on Chinese plastic and rubber continue to rank among the most vulnerable, while categories with strong domestic production show significantly lower risk.

Details of the current scores are at www.numerator.com/tariff-risk-index .

|