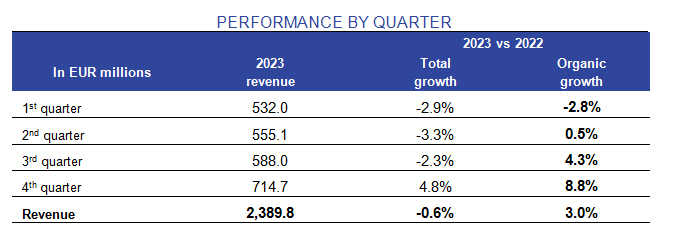

Ipsos has reported organic, constant currency revenue growth of 8.8% for the fourth quarter of 2023, and 3% for the full year, with operating profit stable at an all-time high of 13.1%.

Revenue picked up steadily over the course of the year, although the final figure of EUR 2,389.8m was 0.6% down on last year's due to currency changes.

Fourth quarter reported revenue of EUR 714.7m was up 4.8%, reflecting acceleration once the end of Covid-related contracts had ceased to affect comparisons.

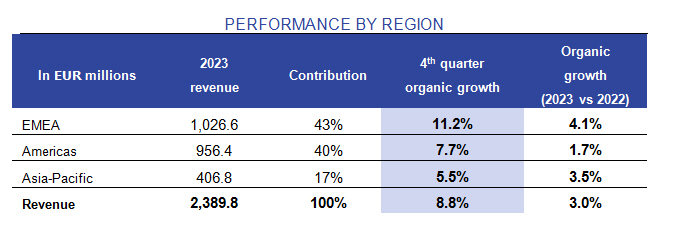

Results by Region

All regions grew strongly in Q4 and grew over the year as a whole. The EMEA region saw organic growth of 11.2% in Q4, and 4.1% in the year as a whole, driven by Continental Europe, with 'excellent' results in France and Belgium.

Revenue in Latin America grew strongly in 2023 (above 8%) while in north America it was almost flat (1% growth), with a significant decline in demand from major tech clients, only slightly reversed in the final quarter. The Asia-Pacific region posted organic growth of around 5.5% for the quarter and 3.5% for the full year, held back by stagnant revenue in China, while India and South East Asia grew in double digits, maintaining their momentum.

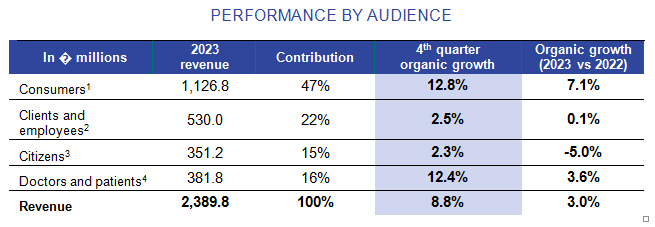

Results by Audience

Activities with consumers showed strong momentum both in the 4th quarter and throughout 2023. On the consumer side brand health tracking, marketing spend optimization, market positioning activities and qualitative work led the way, with a solid performance also in the consumer goods sector.

Among the clients and employees audience, revenue was stable throughout the year, with the decline in major tech client spend offset by strong growth in customer experience and mystery shopping surveys.

Revenue for the 'citizens' audience was down 5%, due mainly the firm says to the ending of major COVID contracts, but outside this area there was strong organic growth at more than 8%.

Revenue for work among doctors and patients continued its improvement throughout 2023, with organic growth of 9% in the second half and 12% in the final quarter. Strong performers included Ipsos' high added-value services offering, and its solutions for targeting and segmenting patients and prescribers.

Gross margin rose by 120 basis points to 67.5%, partly due to very strong momentum from higher margin segments like Ipsos.Digital, Marketing Management Analytics activities and qualitative surveys.

As of 31st December 2023 Ipsos had 19,701 employees, down 2.3% from a year earlier. Acquisition activity gathered pace with EUR 48m spent on buying NVCS in the US, Behaviour & Attitudes in Ireland, CBG in New Zealand, Big Village in Australia, Xperity in the US, Omedia in West Africa and Shanghai Focus RX in China. Jarmany in Great Britain and I&O in the Netherlands were added last month.

The group is forecasting organic growth of more than 4% for 2024, with comparatives having the opposite effect to 2023 in terms of quarters: relative favourable in Q1 and declining thereafter.

Global CEO Ben Page says: 'We improved in 2023 despite economic headwinds, proving the resilience of Ipsos' model. Thanks to our geographic spread, our multi-sectoral approach, client portfolio and new technology, we can feel confident as we step into 2024. Combined with the talent and commitment of our teams, these strengths are exactly what we need to keep responding to new client needs and seizing new growth opportunities'.

Web home page: www.ipsos.com .

All articles 2006-23 written and edited by Mel Crowther and/or Nick Thomas, 2024- by Nick Thomas, unless otherwise stated.

Register (free) for Daily Research News

REGISTER FOR NEWS EMAILS

To receive (free) news headlines by email, please register online